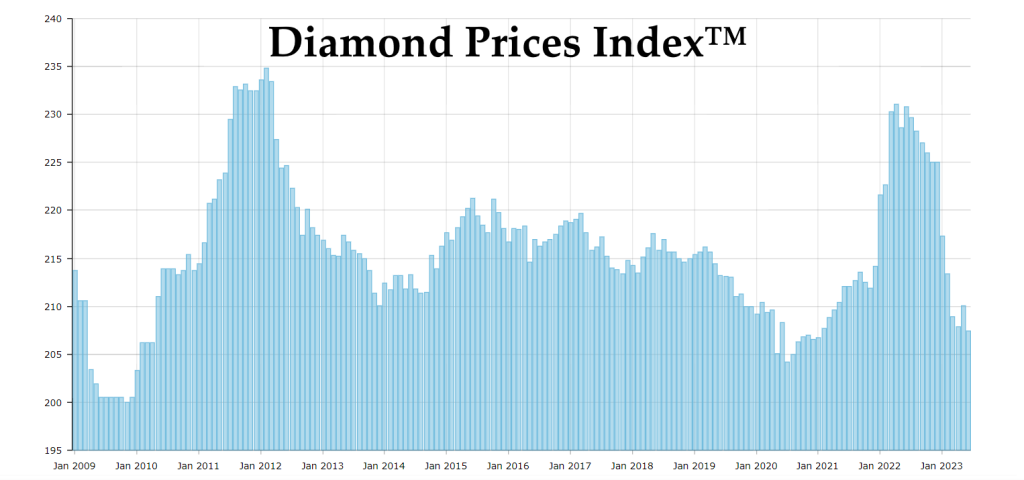

According to the Global Rough Diamond Price Index, prices have fallen 18% from their all-time highs in February 2022 and 6.5% year on year in recent months. Market watchers anticipate that their value will continue to plummet. “A 1-carat natural diamond of slightly above-average quality cost $6,700 a year ago, and today, this same diamond sells for $5,300,” Paul Zimnisky, CEO of Paul Zimnisky Diamond Analytics, told CNBC.

According to industry experts, some of the factors contributing to a weak market include persistent competition from artificial diamonds, a slowdown in China’s economic recovery, and the unpredictability of the macroeconomic climate. In particular, data show that lab-grown diamonds sold versus natural diamonds ratio is increasing. They were just 2.4% in 2020. They are already up to 9.3% in 2023. Lab-grown diamonds are as genuine as natural diamonds. Except for the fact that they are developed in a lab, lab-grown diamonds are identical to earth-mined diamonds in every aspect. They share the same chemical, physical, and visual qualities as mined diamonds, as well as their fire, scintillation, and glitter.

But above all, the data demonstrates that when consumers were unable to go on vacation or dine out, all surplus money was invested in luxury products and jewelry. When the economy recovered, diamond prices began to tumble and drop.

During Covid’s two-year tenure, diamonds seemed to be a safe haven. “Consumers were ready to spend,” claimed management consulting firm Bain & Company in a February study last year. “They were flush with cash from buoyant capital markets and economic stimulus programs, and eager to spend it on meaningful gifts for their loved ones.”